Inflation is back! Unexpectedly and massively

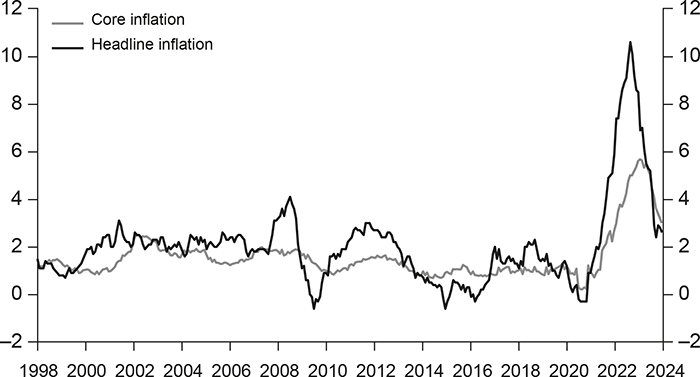

Until the summer of 2021, market participants, analysts, as well as policymakers expected inflation in the euro area to flatline below its target of (symmetrically around) 2%. In fact, since the mid-2010s, the harmonized consumer price index (HCPI) had hovered around 1.5% (see Figure 1 below). During that period, policymakers were concerned about the threat of deflation. In the wake of the Covid-19 pandemic, inflation actually dipped below zero in June 2020. However, this euro area average came with substantial dispersion, both for the overall index and especially for its individual components. Core inflation's1 standard deviation peaked in March 2023 at 6.5% (relative to a mean of 1.7% since the introduction of the euro).

Inflation in the Euro Area

Note : Figure 1 portrays the evolution of the rate of change in the euro area's harmonized consumer price index. Core inflation does not account for the volatile energy and food components.

Source: ECB Data Portal.

Inflation Dispersion Across Euro Area

Note: Figure 2 documents the dispersion of inflation rates across four member states, as well as the euro area average. This dispersion reflected nationally differentiated responses to a (more or less) common shock.

Source: ECB Data Portal.

This heterogeneity was evident not only across countries. Households, depending on the structure of their consumption baskets, were also differentially affected. For those at the lower end of income scales, this quite literally amounted to a cost-of-living crisis. Moreover, given that the capacities (or the readiness) to offer support via budgetary means – fiscal space – was unevenly distributed, this also implied differentiated crises among member states.

Price-levels, of course, rose throughout the world. This commonality was initially the result of pandemic-related lockdowns and supply-side bottlenecks. When the pandemic began fading away, there was also a boost from released pent-up demand. This was particularly strong in the case of the US where, given its much less developed social security net in comparison with Europe, a series of broadly targeted protection schemes had been carried out, with substantial effects on aggregate demand. In addition, in the wake of the pandemic, demand shifted from goods to services, provoking another differential effect on price levels. And, finally, from February 2022 onwards, the Russian attack of Ukraine led to massive increases in energy prices, which meant a commensurate negative terms-of-trade shock for net-energy importers.

ECB monetary policy and euro area heterogeneity

To make sense of these developments, analysts essentially referred to three concepts: cost-push, demand-pull and, although overlooked at first, demand-shift. At least initially, monetary sources of inflation were rarely mentioned. In fact, ever since the Great Financial Crisis of the late 2000s, base money had grown very significantly – but clearly without any effect on consumer prices.

In the case of the ECB (European Central Bank), whose mission is to maintain price stability for the 20 member states of the European Economic and Monetary Union, reining in inflation proved to be particularly challenging. While monetary policy is (mostly)2 unified in the euro area – expressed in the monetary authority's policy rate –, economic background conditions in member states were (and still are) significantly diverse. Thus, differences in national inflation rates reflect a vector of interacting influences: variety in fiscal policy (various budgetary support measures), wage trends, evolution of profit margins (competitive environment, dispersion of market power), sectoral structure (energy intensity), etc. Inevitably, one size monetary policy measures fit these environments differentially.

In the following, we summarize the contributions to this issue of the Revue d'économie financière. We proceed as follows. Section 1 provides for the historical background. Then, in section 2, differences between countries within Europe's monetary union as well as with the US and emerging economies are documented. Section 3 develops the main analytical approaches to understanding why inflation is back. And, finally, in section 4 perspectives on the proper policies to achieve price stability are discussed.

Histories of inflation

Ever since the introduction of the common currency, inflation has been largely kept in check. On average, the annual change in the HCPI has been 2.1%. This is lower than what the Bundesbank was able to deliver during its reign (2.7%). There has also not been much variance across member states for most of this period. Inflation, of course, has also declined in most of the developed as well as the emerging market economies. And with it, nominal interest rates have been on a continuous downward path ever since the 1980s. This held true for the period of the Great Moderation (ending in 2007), but it was also more or less the case during the 2010s.

Inflation: origin(s) and persistence

Inflation, as well as the debates about its sources, is a hardy perennial and has seen the most prominent economists arguing among themselves. Documenting facts and debates since the 16th century, Maxime Menuet contends that, contrary to mainstream histography, understanding inflation's evolution requires going beyond the quantity theory of money. The “Revolution of prices”, for instance – a Europe-wide phenomenon of the 16th and 17th centuries – was accordingly not mainly driven by the discovery of new mines of gold and silver. Instead, various “real” or non-monetary factors had a decisive impact: on the one hand, there was a rising population and hence more (solvable) demand. In addition, a higher demand for cash and thus an increasing velocity of money endogenized the money supply, making it possible to finance this demand. In the 20th century, inflation rhymed with crises and conflicts. For the case of France, for example, purchasing power declined in the wake of the two world wars by 45% (after WWI) and by 56% (after WWII). In principle, the excess demand on stretched productive capacities could be financed by taxes, printing money or by issuing debt – or combinations of the three. In responding to Covid-19, in fact, a combination of debt financing and its monetization (Pandemic Emergency Purchasing Program) was chosen. As far as persistence is concerned, this has been mainly explained by a trade-off between inflation and unemployment or various conflicts (between labor and capital or creditors and debtors). Given that inflationary bursts have typically been the result of energy crises and their budgetary management, Maxime Menuet concludes that the evolution of price levels might be anchored in expected budgetary or fiscal developments, the fiscal theory of the price level (as recently again argued by Cochrane, 2023)3.

Hyperinflation: on the centennial of the German experience of the 1920s, a look back

According to a famous (and contentious) definition by Philipp Cagan, we speak of hyper-inflation when the absolute price level changes by more than 50% per month. The German experience of the early 1920s is emblematic in this regard. As Marc-Alexandre Sénégas and Patrick Villieu report, it had only three precursors since the French Revolution, three countries which contemporaneously befell the same fate (Austria, Hungary and Russia), then barely any until 1984, but then another 41 prior to 2012. Essentially two approaches have been developed to make sense of hyper-inflations:

1– the monetarist view, as conceived by Cagan, stresses the consequences of excessive creation of money, while acknowledging that the ultimate root causes reside in intractable budgetary tensions. The latter reflecting societal and fiscal chaos;

2– with Sargent and Wallace, economic agents decipher the unsustainability of the intertemporal budgetary path – forcing the monetary authority's hands (fiscal dominance) – in expectations. Ultimately, the central bank must give in and monetize debt. In a certain way, the “fiscal theory of the price level” is a variant – with the future price level determined by the mix between fiscal and monetary policy. Subsequently, Marc-Alexandre Sénégas and Patrick Villieu apply these hypotheses to the case of German hyperinflation, concisely confirming an observation by German economist Franz Eulenburg: “The disintegration of money did not happen in isolation, instead, it proceeded in continuous connection with the other factors of social life.”4 More concretely: the inability to honor war reparations as required by the Treaty of Versailles and the intrinsically related societal and budgetary conflicts – which were “solved” by the (independent) Reichsbank by printing money.

Disinflation in Italy: 1980-1997

In the 1950s and 1960s, Italy experienced moderate inflation of about 3% per year. However, in the 1970s, the CPI grew at annual rates in the (low) double digits. At the same time, inflation became quite volatile. This took place, as Ignazio Visco observes, against the backdrop of the first oil-price shock, substantial social and political tensions as well as “strained labor relations”. It also happened in spite of the Banca d'Italia's commitment “to a high degree of monetary stability”. Peaking in 1974-Q4 at 25%, inflation was halved in 1975, but then rose again in 1976 in response to an effective (trade-weighted) depreciation of the Lira by almost 20%. The introduction of a wage-indexation scheme, the scala mobile, was a further driver of inflation. This institutional landscape set Italy's inflation on a roller coaster, peaking twice above 20% into the early 1980s. Disinflation in subsequent years was achieved by less accommodative fiscal policies, more moderate wage increases and an appreciating real exchange rate, which dampened domestic demand and hence inflationary pressures. Subsequently, between 1987 and 1992, the year of the crisis of the European Monetary System, inflation went back up again, hovering around 6%. Then, robust budgetary and monetary policy responses once more launched inflation on a downward path. This was substantially supported by a moderation of wage growth, the result of a “concertation policy” between government, employers' associations, and labor unions – not unlike the German model of konzertierte Aktion.

Inflation: differing across countries and income groups

Cost-of-living crisis in the euro area

The response of European nations to the decline in purchasing power was, according to Helene Schuberth, characterized by “five narratives”: (1) inflation should be reined in through monetary policies; (2) direct price controls were deemed ineffective and distortionary; (3) a possible wage price spiral, not a profit-driven increase in the price level, was the dominant concern; (4) given the substantial terms-of-trade shock to Europe's net importers of energy, wage moderation was called for, in line with the increase in the domestic component of the consumption basket (plus the growth in productivity); (5) fiscal support should target those strata of income distribution that were the hardest hit. Subsequently, she evaluates all five proposals: (1) being the result of interacting shocks (post-pandemic shifts in demand, supply side complications, energy prices surging, etc.), monetary policy continuous to face a trade-off between reducing the output gap and fighting inflation (there is no “divine coincidence” in a world with market imperfections); (2) substantial price shocks, emanating from systemically relevant sectors (read energy) through input-output effects and fostered by market design (the EU's merit order energy pricing system), should have encouraged specific intervention, in particular price caps and a decoupling of electricity prices from gas prices; (3) following Weber et al. (2023), the rise of profit margins (i.e., the difference between sales prices and marginal costs) was a main driver of inflation, a cause which traditional competition policy could not address, instead price control commissions should have been used; (4) using wages to compensate for shocks to terms-of-trade – a variable that historically has fluctuated around the same level – would have put the main adjustment burden on labor income, which would not have been desirable; (5) “establishment macroeconomic thinking” thus translated into a prioritization of deploying central bank tools to contain price-level developments and to some extent fiscal policy instruments to administer price caps or targeted support for low-income households.

Inflation: reemerging in France

After a decade of slowly moving CPIs, inflation's worldwide return came as a surprise, according to Mathieu Plane and Gaston Vermersch. In France, for instance, this return was unexpected and quantitatively very substantial, though less so than in most other regions of the euro area. The various price shields (“boucliers”) deployed to protect French households and firms cost the government budget €60bn. They were complemented by direct support measures and altogether may have reduced the increase in CPI by 3 percentage points in 2022. Income groups were hit differentially by inflation. Workers earning minimum wage and pensioners were best protected, which was not the case for monthly base salaries of other workers, whose purchasing power declined. Non-financial firms were able to increase margins between 2021 and 2023, thereby contributing to inflation. At the same time, this overall increase in margins hides substantial heterogeneity, with some sectors forced to reduce their mark-ups. Households in rural areas, as well as families with low incomes, were comparatively worse off than urban dwellers and higher income groups. The terms-of-trade shock resulting from the spike in energy costs, comparable to the oil price shock of 1973, was absorbed by the public sector and by a significant increase in the net-foreign liability position. While inflation has recently been on a downward path – also in response to the demand-dampening effects of the ECB's hikes in policy rates –, inflation may remain at a higher level for the foreseeable future (geopolitics, costs of adapting to climate change) and become more volatile.

Energy price brakes and tax relief: Germany's effort to limit inflation

Germany's inflation rate soared from –0.2% in December 2020 to 8.8% in October 2022. According to Sebastian Dullien and Silke Tober, the country was hit by an especially drastic worsening of its terms-of-trade as well as by a series of price shocks, which resulted from supply chain bottlenecks and shifting post-pandemic demand, etc.). With wholesale prices for electricity tied to gas prices and determined by the most expensive source, energy prices became the main factors in reducing households' purchasing power. While amounting to only 2.1% of household spending, the 47% increase in household energy costs contributed 2.1 percentage points to the overall inflation rate in October 2022. The burden fell disproportionately on lower income households. For example, of the 10.5% inflation rate for low-income adults, 7.7 percentage points could be accounted for by two categories (food and energy). In response, a variety of fiscal relief measures were implemented (tax cuts, subsidies for commuters, one-off payments for employees and children, lower temporary VAT for natural gas, payroll taxes that were exempted from increases due to inflation, etc.). Based on the proposals of an expert commission in October 2022, a temporary price cap on gas for households and firms was introduced. These measures lowered inflation, increased households' disposable income and contributed to calming consumers' concerns. Thus, fiscal policy measures cushioned the downturn and contributed to keeping a lid on inflation. According to Sebastian Dullien and Silke Tober, this shows that monetary and fiscal policy can cooperate in the framework of the ECB policy strategy. Given the context, the authors argue that the ECB would have been better advised to “show a bit more patience”.

Root causes of the inflation surge in the US

The sudden and rapid surge in inflation was, as Hélène Baudchon observes, unexpected and unprecedented. Initially, the inflationary push resulted from “a simple change in relative prices”, more specifically: the price of gas and, more generally, energy. While in Europe inflation was mainly driven by energy prices, in the US the 6.1% increase of the CPI in 2021 consisted of three components: energy prices (2 percentage points), underlying inflation (3.6 percentage points) and food prices (0.5 percentage points). In the first half of 2022, when inflation reached its peak of 9.1%, energy was responsible for 55% of the increase and food prices for a quarter. The underlying mechanics of this loss of purchasing power were an initial supply shock, complemented by a post-pandemic demand pull (pent-up demand, expansionary fiscal policy). Against this background, the pricing power of firms rose. Supply-side factors seem to have dominated the trajectory of US inflation. This assessment is also buttressed by the analysis of Ben Bernanke and Olivier Blanchard, who diagnose a series of shocks in commodities and goods markets (which produced various bottlenecks). Moreover, the imbalance between limited supply and powerful demand also allowed for profit-driven inflation. Most of these shocks were singular events, bound to fade over time, which made them transitory. For reasons of deglobalization, decarbonization and demography (aging, lower savings, higher public sector spending), central banks going forward might be faced with an environment of structurally higher and more volatile inflation. Still, the goalpost should not be moved, the inflation target should remain at 2%.

The inflationary shock in emerging and developing countries

Emerging and developing countries experienced the cost-of-living crises in different ways – mediated by different responses to the pandemic, their respective dependence on fossil fuels (as importers or exporters), their reliance on food imports, as well as differing economic policy approaches. This meant, according to Pierre Jacquet, that while there were country-specific situations, nonetheless a common, world-wide factor can be identified. Price developments in energy and food were largely synchronized, owing to common exogenous factors (energy and food, as well as supply chain bottlenecks). At the same time, while largely following idiosyncratic paths until the mid-1990s, since then underlying inflation rates have also moved more closely together. Based on more rigorous monetary policies, the “median” or representative emerging and developing economy has made remarkable progress towards disinflation. However, institutional vulnerabilities remain. Four sources of inflation are particularly pertinent: budgetary imbalances, which can force the hand of monetary policy or generate balance of payments/exchange rate crises; overheated economies; supply shocks; and, finally, inflation inertia as a result of expectations that are not well-anchored. It is important to recognize that the situation in developing countries and between regions is highly diverse, something that the median does not properly capture. Moreover, low-income developing countries are the most vulnerable. At the same time, the capacity to control inflation is positively associated with the level of income, possibly reflecting the reliability or credibility of institutions associated with a larger GDP. Remarkably, those countries that pursued inflation targeting strategies do not seem to have done better. While there is no well-defined threshold beyond which inflation undermines growth, very high rates of inflation are clearly detrimental. Also, comparatively higher national inflation rates mechanically entail a loss of price-competitiveness, which at some point must be corrected through depreciation. Ultimately, these experiences were conducive to establishing a new political paradigm in developing economies: acknowledging the constraints of the external environment has led to attempts to gain credibility, to be seen as responsibly conducting stability-oriented policies. To understand underlying drivers of inflation in developing economies, three background conditions have to be accounted for: dependence on the access to international funds limits the room for maneuver and makes it necessary to follow the course of the lead economies. Inflation, an increase in absolute prices, is more than a macro phenomenon. It reflects changes in relative prices and has impactful consequences on income distribution, especially hurting the poorest households. Finally, a weaker currency increases the burden of net external liabilities and reduces the access to international funds. While generalizations are difficult, given the substantial diversity between countries, understanding the consequences of inflation requires not only accounting for monetary and budgetary issues, but also acknowledging the impact on poverty and food security, as well as external indebtedness.

Approaches to making sense of inflation

Phillips curve: still pertinent?

Ever since the Great Financial Crisis, the relation between unemployment and inflation seems to have gone missing in action. Labor market developments don't seem to impact the evolution of price levels anymore. Christophe Blot deploys the “triangle model”, capturing the influence (or not) of demand pressures (for example, proxied by the deviation of the unemployment rate from its structural level), supply side or relative price shocks and inflation expectations, in order to trace the evolution of quarterly US inflation data between 1950-Q1 and 2023-Q3. The slope of the Phillips curve is unstable and becomes statistically insignificant after 2000. This demonstrates the often-reported flattening of the Phillips curve. That outcome could result from measurement issues. The equilibrium unemployment rate is non-observable. Expectations might be mis-specified. Relative price shocks might come in different versions. Accounting for such alternative measures and using a sample of quarterly data since 2001 resurrects the Phillips curve. The slope coefficient has the hypothesized sign and is significant. While the Phillips curve seems to be “alive”, i.e., has not disappeared, the relationship is not stable but time-variant and context-dependent. Structural changes could be the result of more effective monetary policy (well-defined primary objective and transparent communication), which should anchor expectations. Therefore, relative price shocks should become dominant. With deeper integration of markets and value chains (outsourcing), the world (instead of the domestic) cycle gains in pertinence. On the whole, the Phillips curve perspective offers a flexible framework to understand the different drivers of inflation.

Money growth and post-pandemic inflation surge

With the weakening of the link between money and inflation since the 1990s, the monitoring of monetary aggregates has fallen into almost complete oblivion. However, Claudio Borio, Boris Hofmann and Egon Zakrajšek document “a surge in money growth [preceding] the flare-up in [inflation] in 2021-2022”. Cross-country evidence shows that the link between money and inflation is a two-regime process. In low and stable inflation environments, price-levels change mainly in response to sector-specific relative price shocks. Conversely, in the second regime of high inflation the common component of price variations becomes dominant and the correlation between relative price changes increases substantially, closely following changing “salient prices” (energy, food, exchange rates). The link is strong in high-inflation contexts and vice versa. Between 2020 and 2023, the correlation between “average excess money growth and average inflation” was 1. This in-sample correlation between excess money growth and inflation also had predictive power in 2021-2022, though a (substantially) lower one when excluding two high-inflation nations. Subsequently, during a period of declining inflation, this correlation becomes insignificant when the two high-inflation economies are excluded. The findings suggest that while it is challenging to exploit the information content, monitoring and assessing the evolution of monetary aggregates can be useful.

Heterogeneity of inflation's effects in France and the euro area

Inflation exerts its effects differentially, across households (income groups), contingent on the structure of their expenditures. Based on household specific data collected by the Insee as well as Eurostat (Household Budget Survey), Erwan Gautier and Jérémi Montornes observe that the increase in price levels was the consequence of significant shocks in relative prices (energy, food). They accounted to a large degree for overall inflation. In the case of France, more expensive food and energy (a quarter of the consumption basket) explained almost 2/3 of overall inflation. But there was also heterogeneity in terms of price increases between countries, reflecting differences in policy responses. France and Spain had lower overall price level increases because they capped energy prices. Differentiation of effects also mirrored differences between income groups, age, and geography. Low-income households spent more on food and energy. Households in rural areas had higher costs for transport and heating. Old-age consumers spent more on food and housing. Between the four large euro area economies, for the first income quintile, shelter (rent, electricity, gas, etc.) amounted to 40% of expenditures; for the last quintile, it was a significant 10 percentage points less, only 30%. Since the share of essential expenditures is about 2/3 of total consumption, low-income households are most affected by rising inflation. In comparing differential effects between Germany, France, Italy, and Spain, interquintile differences were similar, except for the case of Italy. While there was a substantial diversity in national responses, countries with the most protective interventions also experienced lower inflation rates and lower inequality effects. For the case of France, for instance, the “boucliers tarifaires” seemed to completely eliminate the inequality effects between the first and the fifth quintiles. The dispersion of inflation between rural and urban areas in France was also reduced by subsidies for gas prices. To support targeted policy interventions, analyses based on more granular data are required.

Structural change and distributional conflicts

Inflation cannot be understood as a purely monetary phenomenon, as standard monetary theory pretends. Instead, Jean-Luc Gaffard, Mauro Napoletano and Francesco Saraceno hold that the analytical horizon must be widened. From a conventional perspective, inflation is the inevitable result of policies that aim to push unemployment below its natural level and hence start a wage price spiral. In this vein of reasoning, only structural reforms, dealing with market imperfections, can address the issue. But inflation cannot be understood only in macroeconomic terms, juxtaposing demand and supply. It can also be a phenomenon of structural origin depending on the continuous evolution of preferences and technologies, which imply variations in relative prices and affect the general price level. In the presence of downward price rigidities, shifting relative prices imply inflation. They also have distributional consequences and therefore imply conflicts about who bears the costs. Conflicting claims between labor and capital have different consequences, depending on market power and the path of inflation. In the most recent episode, the issue has not been a wage price spiral but the augmented market power of firms, which has allowed for wider margins and fanned the flames of inflation. Therefore, managing a cost-of-living crisis requires going beyond pure monetary policy. In acknowledging the role of financial intermediaries, as well as corporate governance, in determining the outcome, incomes policies have to be reconsidered. Complexity must be acknowledged. Which is particularly challenging in the euro area with its diverse regional landscape.

Where do we go from here?

Inflation targeting in an uncertain environment

During the Great Moderation, strategies and objectives of central banks became ever more similar – unsurprisingly so, given that most economies were deemed to be on stable paths. Recent shocks and foreseeable challenges reopened debates about the objective(s) of monetary authorities as well as their strategies, issues addressed in Pierre Jaillet's and Jean-Paul Pollin's contribution. Over the last quarter of a century, monetary authorities have more or less converged on the same definition of price stability – the 2% target. Given that inflation concurrently generates costs (e.g., distortionary effects on relative prices and the allocation of resources) and benefits (e.g., easing adjustment processes in environments with rigidities), this raises the question of the optimal rate of inflation. Optimality here means that such a rate would allow for efficient adjustment or reallocation processes when agents (firms, labor) are heterogenous. That is, the objective to be pursued depends on the context and potentially varies across jurisdictions and time. The effective lower bound on the policy rate has also to be considered when determining the objective. Since the 1990s, when intermediate (money supply) targeting became unfeasible because of deregulation and financial innovations, pursuing the end goal directly became the dominant approach. Inflation targeting also meant that central banks had to account for the channels through which their impulses were mediated. With the flattening of the Phillips curve during the low-inflation 2010s, the Fed, as well as the ECB, revised their strategies to gain more flexibility. The Fed opted for average inflation targeting, the ECB for tolerating deviations from its target for a not precisely defined medium term. Both approaches are conceptually close to pursuing price level objectives. Meanwhile, a debate about raising the target to 3% or 4% has re-emerged, among other reasons, in order to create more room for maneuvering and to support the effectiveness of monetary policy in the face of a structurally low equilibrium interest rate (r*). As in the early 2010s, the dominant view is, however, that changing the objective in an uncertain environment risks increasing uncertainty. In view of a heightened ambiguity about the future inflation regime, other options are being discussed (price-level targeting, nominal GDP targeting). The optimal target is also assessed relative to (1) its pertinence for the ecological transition, (2) the new industrial revolution (AI, digitalization) and the natural interest rate and (3) the sustainability of public and private sector debt positions. Ultimately, the challenge is to decide on an optimal target that takes into account the various conflicting objectives.

Market power and inflation

The recent and sudden burst of inflation had microeconomic root causes: pandemic-related lockdowns (disrupted supply chains and demand, shifting between sectors), as well as the Russian war in Ukraine (and its consequences for energy prices). To understand such price shocks, Benoît Cœuré argues that a sectorial perspective, acknowledging input-output relations and substitutability, is needed. In this context, firms' pricing behavior becomes crucial, which may imply that competition policy has a role to play in achieving price stability. For the case of France, while margins (= operating income/value added) rose by 2 percentage points between 2021 and 2023, during the previous two decades they remained in a comparatively narrow band. From a macroeconomic (and simple accounting) perspective, increased mark-ups might result from rising labor productivity, declining real wages, improved terms-of-trade and/or higher net subsidies. In the most recent episode, a “typical” French firm could increase its margins mainly by two means: (1) by delaying the adjustment of wages to higher prices and (2) by passing on increasing input costs. In an imperfectly competitive (e.g., a monopolistic) market, sales prices include a mark-up, whose varying size is a metric of market power. Industries with a higher concentration ratio (fewer competitors) should, in principle, show a lower correlation between input costs and (sales) prices. Research, however, does not unambiguously confirm these hypotheses. Confounding factors (supply-chain disruptions) have to be acknowledged. Moreover, margins (or mark-ups) vary substantially between and within sectors. Therefore, generalizing from individual cases (firms, sectors) is unsatisfying. Attempts to attribute the respective contributions of labor costs, taxes net of subsidies and mark-ups to overall inflation vary across time and nations (and studies). For instance, according to the IMF, between 2019 and 2021, 40% of the increase in the US GDP deflator could be explained by rising unit profits. Context matters. For instance, there is a difference between net exporters and net importers of energy. Profit-inflation is, in any case, a temporary phenomenon. In a broader context, the competing claims of capital and labor that is captured, for example, in the wage-setting/price-setting model, come into play. This impacts a potential “profit inflation spiral” via its effect on equilibrium unemployment and the shape of the Phillips curve. With labor's weaker bargaining power, the role of firms' pricing decisions in inflation dynamics might increase. Between the mid-1980s and the mid-2010s, margins of the median firm barely increased in the US and were largely stable in France. However, against the background of increasing concentration ratios (as measured, for instance, by the share of an industry held by the 4 largest firms) margins rose in particular for dominant firms (a composition effect). Increased market power, i.e., higher monopolistic rents, can raise the level of prices (a long-term effect). Here, competition policies may play a limited role. For instance, by combating cartels or tacit collusion, by evaluating mergers and acquisitions, by checking the abuse of dominant positions, or by evaluating policy projects with a competition aspect. Obviously, it is not competition authorities who hold the prime instrument for combating inflation. But, by encouraging a competitive environment across markets, they can contribute to achieving the price stability objective.

Inflation and fiscal policy: in search of a new paradigm

In the wake of four major economic shocks since 2007-2008, macroeconomic stabilization tasks have been re-assigned, raising paradigmatic issues that Xavier Ragot addresses in his contribution. Beginning in the 1980s, a new division of tasks between monetary and fiscal policy became dominant. Achieving price stability was the responsibility of independent central banks, which were given a clear mandate. Monetary authorities were also deemed responsible for stabilizing aggregate demand. This monetary dominance regime reflected “lessons drawn” from a period in which the public sector budget was supposed to control aggregate demand and thus inflation. Control was to be exerted via the price level's close and stable connection to the output gap (i.e., the Phillips curve). Depending on context, funding budgets by monetizing debt was deemed appropriate. Fiscal policy was dominant. In the 1970s, however, this functional-finance approach (à la Abba Lerner) was found wanting: when oil prices quadrupled (a negative supply shock), this moved the price level and output in opposite directions. The relative price increase had a direct effect on inflation, changing the absolute price level. Concurrently, the shock reduced aggregate demand, leading to income stagnating. This thus leading to income stagnating and hence to contradictory challenges for stabilization policies. Since it was judged to be incapable of preventing stagflation, from the 1980s onward, therefore, fiscal policy was supposed to refrain from discretionary interventions. Instead, the focus was to be on its (Musgravian) allocation and distributive role, with automatic stabilizers operating only the background. Concerning macro-stabilization, central banks were supposed to be in the driver's seat: monetary dominance. However, the four big crises since 2008 (the Great Financial Crisis, the euro area periphery sovereign debt crisis, the pandemic-induced public health crisis, and the Russian war in Ukraine and the subsequent energy crisis) have shown the limits of monetary policy's capacity to intervene. Fiscal policy was brought back into play. There is a particular European angle to this. Within the euro area, regionally diverging inflation rates, which also reflect differences in budgetary policies, impact real exchange rates. This has consequences for current account balances. The crisis-induced re-hierarchization of policy tools in macro-management has also been confirmed in recently developed models with heterogenous agents. When prices and wages adjust only stickily, these models show that fiscal policy is the more effective tool in managing the cycle and stabilizing prices. However, fiscal policy pursues much more than just price stability objectives. It deploys a multiplicity of tools, impacting e.g., incentives of agents, transferring resources between them, etc. Therefore, a variety of implementational limits has to be acknowledged: issues of legitimacy, justice, informational constraints, agents' difficulties in comprehending fiscal policy's complexity. These limits concurrently confirm monetary policy's comparative advantage (operational independence, strong analytical capacities in its domain). Therefore, the “rehabilitation” of fiscal policy, as well as the necessity of taking advantage of monetary policy's “symmetric qualities”, calls for institutional reforms. This is particularly relevant for the euro area. For reasons of democratic legitimacy, national parliaments must remain in charge of their budgets. But they should make decisions in view of all the implications, including those for the evolution of the overall price level. The already existing European network of independent fiscal councils should also be tasked with informing parliaments about the impact of their budgetary decisions on inflation and internal exchange rates (evolution of relative prices across the euro area). Charging fiscal policy with stabilizing inflation and cushioning large-scale shocks requires analytical and institutional innovations.

By way of conclusion

There were not many who saw “it” coming. “It”, i.e., the sudden and abrupt rise in price levels all over the world was under-appreciated by market participants, analysts and, perhaps most importantly, central bankers. Then, when headline inflation appeared to be on an inexorable upward path, serious debates among serious people arose as to whether it would be “transitory” or “permanent”. This was also a debate about inflation's root causes – was it demand or supply-side driven, or was it a matter of compositional shifts? In the US, “team transitory” argued that the sudden burst in inflation was mainly a relative price shock and that it would eventually peter out. This was, of course, the canonical “supply-shock” interpretation (Blinder and Rudd, 2013). In this view, underlying inflation is jointly determined by demand and supply-side factors. Large price increases in important sectors, without offsetting relative price declines in others, lift the overall price level mechanically. But this cannot continue. Inexorably, the headline rate goes back to the core. More protracted deviations could persist only if a wage or profit-driven cost price spiral were launched. “Team permanent”, on the other hand, opined that US inflation was the consequence of massive fiscal stimulus (CARES Act, Paycheck Protection Program, American Recovery Act, etc.) that responded to the Covid-19 pandemic but pushed the economy way beyond its capacity. Therefore, to bring inflation back on target, a strong contractionary policy was called for. This might risk letting unemployment almost double to 7%.

In February 2024, US headline inflation stood at 3.2% and core at 3.8%, with unemployment hovering below 4%. While it might have taken a while longer, also because of the impact of a sequence of interacting shocks, team transitory's assessment seems to have been borne out. In the euro area, there was significantly less of an aggregate demand effect. With its more developed social security systems when compared to the US, support measures were more targeted. Still, changes in price levels in member states followed a similar downward path.

In the meantime, with the energy component of the overall basket in the euro area declining and the food component moderating, is inflation back on course toward its target level, i.e., 2%? The contributions to this issue of the REF convey a cautionary message. They argue in favor of adopting a broad perspective, of accepting that inflation is a multi-causal affair. Therefore, reliance on only one indicator (e.g., money) will not do. To make sense of the evolution of the price level (absolute price), one has to account for the pull of aggregate demand. But there is also a push, as well as a shift factor. Relative price shocks emanating from key sectors of an economy are absorbed in different, context-dependent ways. Unless there are compensating changes in relative prices elsewhere, large shocks have a direct effect on the price level, though not a persistent one on inflation.

The stubbornness of inflation is also rooted in attempts of negatively impacted agents (labor and capital) to protect their purchasing power or their profit share. However, these “competing claims”, to which also absorptive public spending should be added, face a limit: an economy's capacity to create value. A typical means to reconcile such conflicting claims on output has been to loosen the nominal constraint by letting the price level rise. Demands for higher wage income (raising unit labor costs) are made compatible with protecting the return on capital (increasing markups over “normal” cost) through inflation. This conflict-focused view of inflation processes has recently been instructively revived (Lorenzoni and Werning, 2023). It was the ligne directrice of an excellent textbook (Carlin and Soskice, 1992), building on pertinent precursors (e.g.: Kalecki, 1937; Rowthorn, 1977). In view of looming economic perspectives (friend- and near-shoring, dominance of national security topics, green and digital transformation), it is easy to imagine that such conflicts will gain in intensity. This would imply higher underlying inflation. Such a prolongation of the cost-of-living crisis could also come with political-economic costs. While a monetary phenomenon, inflation is a “symptom of some real economic, social and political difficulties” (Tobin, 1987).

March 2024